Society calls for mandatory financial education | YBS

Yorkshire Building Society has submitted evidence to the Government’s Curriculum and Assessment Review to support its calls for financial education to be mandatory in all schools. Research suggests that money habits are usually formed in childhood, by the age of seven, but in England, financial education is not on the national curriculum for primary schools. Financial education is currently on the curriculum for secondary schools across the UK. However, in Scotland and Wales, financial education is on the curriculum for both primary and secondary pupils.

Polling and analysis for the Society’s own Saving Generation Z report suggested that only two-fifths (42%) of 16-27-year-olds had received financial education at secondary school despite it being on the national curriculum since 2014. Despite this group being the first generation where most members should have received at least some financial education, almost two in five (39%) 16–27-year-olds, twice the rate of the general population, said they lacked the confidence needed to make important financial decisions.

Chris Irwin, director of savings at Yorkshire Building Society said: “Our research into the financial resilience of young people has highlighted areas, such as debt, scams and budgeting, where many people are struggling and almost two fifths report that they don’t have the confidence to make important financial decisions. Worryingly less than half recall ever receiving any formal financial education at school – this is despite it being on the national curriculum for ten years.

“We also found that most young people rely on family to learn about money, meaning those from less financially savvy families may be at a disadvantage. There is an opportunity for us to help future generations have the best start in life, by teaching them important life skills and core financial information at school.

“Delivering financial education consistently in schools, from a younger age, and in a way that helps people have the knowledge to deal with real-life challenges, will help more people have a good start in life, and face the future, and its challenges, with confidence and optimism.”

The Society’s recommendations include:

- Creating an entitlement for all children to learn financial education across each stage of education: Making financial education a compulsory part of the national curriculum within every stage of education, with content embedded across different subjects, adequate curriculum time devoted to it and the required resources made available to help teachers and their partners deliver it. This would mean making financial education compulsory for primary school children, and also ensuring young people continue learning about finances after 16, to prepare them for work, life and further education.

- A focus on how financial education is sequenced: Financial education is often taught through ‘one off’ interventions or as a standalone issue within various subjects such as Maths, PSHE and Citizenship. As with any subject, financial education has a greater impact where it is taught as part of a well-planned curriculum which builds secure foundations and then links these to more specialist knowledge. A “little and often” approach, especially in the early years, is more effective at helping children to understand the concept of money and develop healthy attitudes towards it - normalising good habits and making retention of information easier. For older children it is also important to align financial education with the delivery of careers education so that young people learn about relevant topics – for example, the contents of a payslip.

- Ensuring content is timely, relevant and reflects ‘real world’ issues: Financial education is a subject where content can quickly become out of date and requires flexibility. Since the last major curriculum review, the way in which people use and interact with money has been transformed via new technologies such as contactless payments, and cryptocurrency, whilst the potential for financial abuse has grown and diversified. Despite their comfort with technology, Yorkshire Building Society research has found that young people are more likely to say they have experienced online scams than other generations, underlining the need for support as finances increasingly move online [1]. It is therefore vital that the content of a new curriculum reflects the financial world children are growing up in but also builds flexibility for teachers to adapt this over time, so that it remains up-to-date.

- Creating a more coherent and effective approach to financial education across the whole school curriculum: There is a need for a more coherent and effective approach that builds on the current requirements of the national curriculum. As at primary age, financial education at secondary school can be effective when it is delivered cross-subject through a coherent curriculum that links together different aspects of financial education. In practice, this means integrating financial education into the curricula for Citizenship and Personal, Social, Health and Economic education and using them as the leading means for teaching young people about the importance of financial wellbeing and resilience, so that they are able to make informed choices that are right for them.

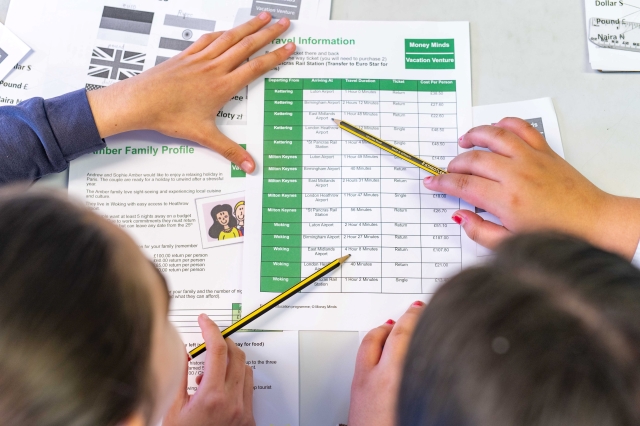

- Supporting teachers with training and resources: We recognise that adding a greater focus on financial education will create new demands on curriculum time and on teachers themselves. It is crucial that any changes to the curriculum in this area are supported by the provision of training and materials to support teachers to deliver it effectively. This is a subject area where external organisations can play a significant supporting role. External experts such as banks, building societies and charities can add greatly to the provision of financial education in schools and colleges by helping to bring the subject to life and underlining its relevance to life beyond education. To help ensure external provision is more effective in supporting financial education, we believe this should be better coordinated - including by bringing together efforts from across the financial services sector.

Read Saving Generation Z: how 16-27 year olds spend and save here. For more information about Yorkshire Building Society’s flagship financial education programme, Money Minds, visit www.ybsmoneyminds.co.uk

References

1. Saving Generation Z: how 16-27 year olds spend and save. August 2024